[ad_1]

© Reuters

The worldwide commodities market is witnessing a fancy interaction of provide and demand dynamics, with Goldman Sachs sustaining a bearish outlook on lithium, at the same time as iron ore costs obtain a lift from Chinese language financial stimulus expectations. The funding financial institution has projected further potential declines in lithium costs, with spodumene spot costs already having plummeted over 75% to $1,650 per tonne this yr. This pattern is mirrored in China, the place costs for lithium hydroxide and carbonate hover round $19,000-$20,000 per tonne, respectively.

Analysts at Goldman Sachs consider it is too early to count on a market rebound for lithium. They anticipate a surplus of the metallic, with projections exhibiting an extra of 29K tonnes LCE (lithium carbonate equal) in 2023 that would swell to 202K tonnes LCE by 2024. This upcoming surplus is attributed to elevated manufacturing that’s not being matched by the expansion charges within the electrical automobile (EV) sector.

In Australia, non-integrated refineries are dealing with excessive prices for lepidolite and spodumene inputs averaging between $19,000-$27,000 per tonne. These prices might result in vital losses because the business grapples with a predicted surplus. Core Lithium (OTC:) is feeling the monetary strain on its BP33 mine, though its share worth has been solely mildly impacted attributable to merger and acquisition hypothesis.

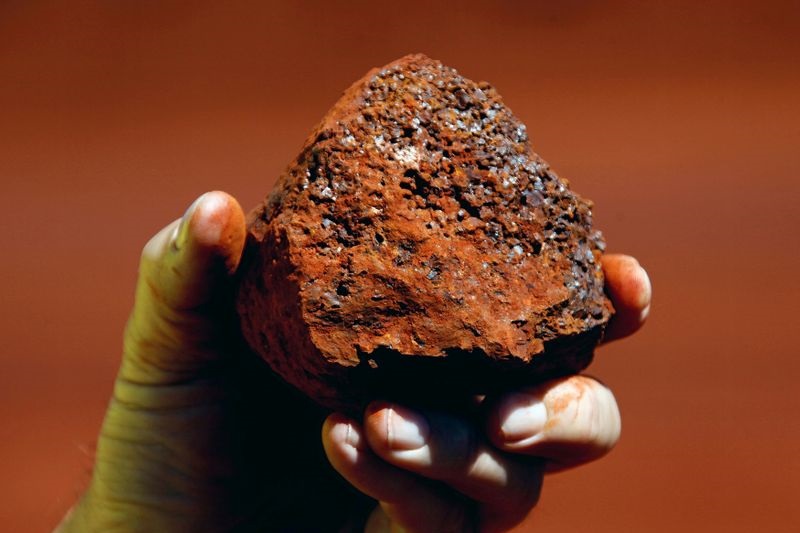

Contrasting this bearish view on lithium, the iron ore market is experiencing near-record inventory ranges following Fortescue Metals Group (OTC:)’s (FMG) annual basic assembly (AGM). Iron ore demand has surged, pushing costs to $134 per tonne. This enhance is essentially pushed by prospects of Chinese language financial stimuli. The optimistic sentiment extends to different main miners comparable to BHP and Rio Tinto (NYSE:).

Gold miners are additionally seeing their fortunes rise as gold costs crest at $2,000 per ounce. This uptick comes regardless of potential future pressures from a strengthening U.S. greenback as indicated by latest Federal Open Market Committee (FOMC) minutes.

Within the gold sector, De Gray Mining reported positive aspects after increasing sources at its Hemi gold challenge past 10 million ounces. Traders are additionally anticipating dividends from FMG’s worthwhile iron operations regardless of scrutiny over government remuneration and authorized issues involving board members highlighted throughout their AGM.

Goldman Sachs challenges the widespread narrative of sluggish mine ramp-ups by mentioning that new mining initiatives are attaining capability extra shortly than anticipated and with improved restoration charges. Nonetheless, they notice that underground mining prices have escalated by round 40%, which might impression future profitability within the sector.

This text was generated with the assist of AI and reviewed by an editor. For extra data see our T&C.

[ad_2]

Source link